Barton Biggs was one of the absolute best stock market commentators in the 1980s and 90s. He was a partner at Morgan Stanley for over 30 years and the firm’s first Global Strategist. I saved one of his commentaries from 1982, which talks about the need for different strategies in different times.

“Winston Churchill in his great series on the Second World War wrote that after the Battle of Alamein in November 1942 when Alexander beat Rommel in the desert, the ‘hinge of fate turned.’ ‘Before Alamein,’ he wrote, ‘it may almost be said we never had a victory. After Alamein we never had a defeat.’ However, Churchill found that he needed very different combat leaders after the hinge of fate turned and the British Army went from the defensive to the offensive. The regiment and division level officers who for so many long years had fought so bravely in rear-guard actions, retreating, containing the damage, conserving their forces against the secular trend of a superior enemy, by 1943 had the wrong instincts trained into them for successful offensive action. They had been conditioned by their experience and were simply unable to commit troops and boldly exploit victories by pursuing a fleeing enemy. They were too cautious. They always looked for the trap, believing the Germans would turn on them and the gains would be dissipated.”

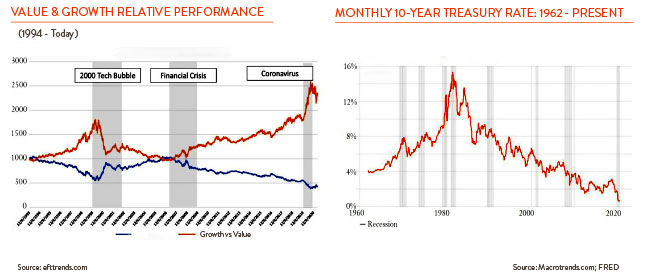

In the stock market, we are conditioned by the most recent past, by prevailing trends, and by the human reluctance to stand apart from the crowd, especially when we are experiencing short-term underperformance. Look at the two charts below. Interest rates have been coming down now since 1981. The lesson has been, buy bonds and you will get both income and price appreciation as your bonds go up in value as rates fall. But what talents are needed when the curve turns?

Value investing, which is buying sound companies selling at below average valuations has outperformed growth over the long term, but since the Housing Bubble of 2008, Value has significantly underperformed. The lesson here has been, buy momentum, buy the stocks going up, and do not be too concerned about valuations.

Well, the one constant in life is human nature rarely changes. We swing from optimism to pessimism and back again, and trends that we think are in place forever — well, they often change. Going forward, fixed income investors may have to factor in persistently rising rates and invest accordingly — favor less risky shorter bonds rather than longer-term ones.

And in the stock market, the pendulum may be shifting to a focus on valuation (Value stocks) and away from buying stocks just because their price is rising. Investing is not just about numbers; it is also about understanding history and understanding your own emotions which can wreak havoc on a sound investment strategy. “History may not repeat itself, but it often rhymes,” as Mark Twain is reported to have said. Be prepared for change.