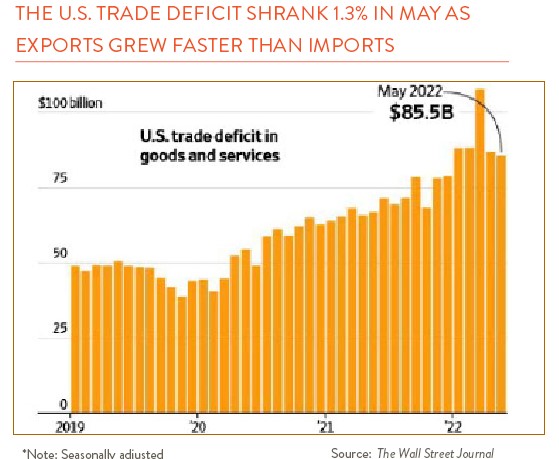

We will deal with the ugly and the bad first, then get to the good. Just look at the chart below right. It gets a lot of people really agitated. Imports have exceeded exports for years, and even though the chart says exports are improving a bit (relatively), we will not get to a balanced state anytime soon.

The pessimists are all over these stats… The US doesn’t produce anything anymore. We rely on low wage countries for everything. We are more concerned about “where is my container?” than what are we doing to create jobs in the U.S. When we try to “reshore” production, we discover we have lost the domestic supply chain and the skills necessary for production. And what happens if the rest of the world gets tired of holding all the dollars we send them to pay for imports? If mass selling ensues, there goes the value of the greenback.

You would think from all this that the U.S. is going to hell…or worse. Well hold on. The U.S. economy globally is still perceived as strong, and we can do the math to back this up. Foreign Direct Investment (FDI) is what companies do when they invest outside their own country. Think what Caterpillar does when it builds a new factory in Brazil or Asia. Or what a software company does when it sets up a sales office in, say, Europe. And what a natural resource company does when it buys a mine or mineral company in Africa or South America.

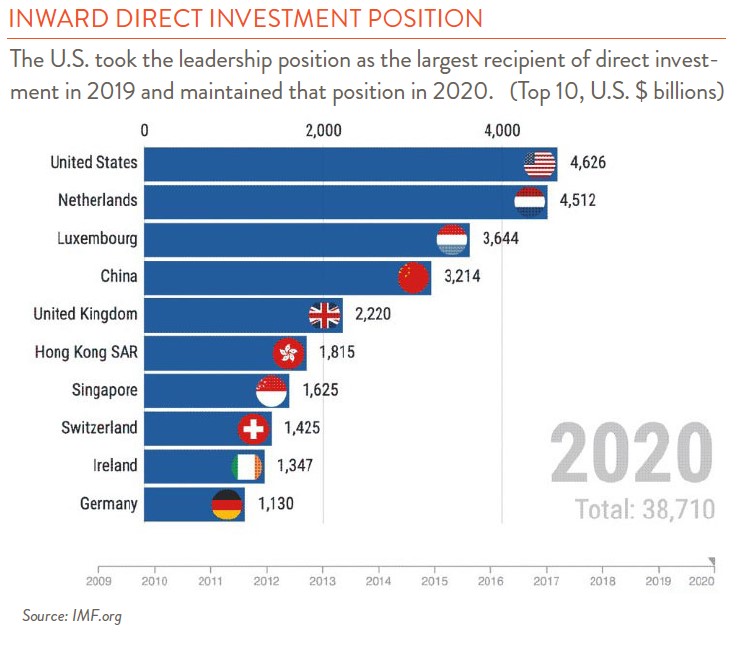

And who gets all this FDI? The U.S. is head and shoulders above everyone else in inward FDI (see chart). This obviously means global companies think favorably of our market. The U.S. has garnered 26.1% of all inward FDI since 1981, according to Joseph Quinlan, the head Market Strategist and Chief Investment Officer at Merrill and Bank of America Private Bank, who has done considerable work on FDI over the years.

And then there is outward FDI, the amount U.S. companies invest abroad. Here again the U.S. is #1. And it is not primarily companies looking for low-cost labor with the idea of sending production back to the U.S. The bulk of our outward FDI, about 60%, is in developed countries, and 90% of what is produced abroad is sold to the local market. U.S. multinationals are investing abroad primarily to take advantage of foreign buyers. The parent company in the U.S. benefits by employing home office and R&D staff and exporting services to foreign affiliates.

Sales of U.S. company foreign affiliates are significant. They amount to over two and a half times the value of U.S. exports. And none of these foreign affiliate sales are included in Gross Domestic Production (GDP), which includes just domestic production and sales. The U.S. economic machine is still a power.

And just a side note on another country. The Netherlands is a small and sometimes overlooked country. But it is an economic powerhouse. It ranks in the top five in both inward and outward FDI globally. Companies like Royal Dutch Shell, Philips, Unilever, Ahold (supermarkets), ING, ASML (photolithography for chips), and a lot of private real estate concerns have global clout.