Most of us are aware of the lack of supply in the current housing market. But just 15 years ago we faced the opposite problem. History can provide a helpful perspective, so let’s go back to the 2000s and look at how we ended up with such an oversupply prior to the Great Recession of 2008 – 09. And why, over the past two decades, have we swung between extremes?

If we could perfectly plan the housing stock in the country, it might grow at some rate that relates to population growth, trends in household formation, death, divorce, etc. But we cannot have perfect insight into those trends, nor do we centrally plan the housing market. Instead, in our market economy, housing is often driven by incentives – and for homebuilders to homeowners and financiers – profit.

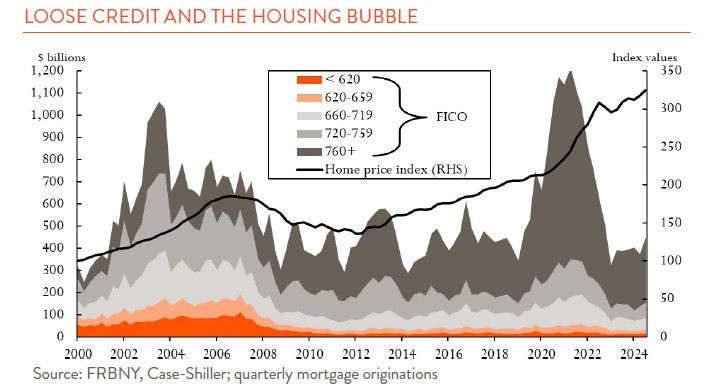

In the 2000s, the housing market was red hot, fueled by cheap and easy credit. Mortgage rates got down to 5% from nearly 19% two decades earlier. Financial regulations, and prudence, loosened up, which expanded access to credit and increased the number of would-be buyers. Homeowners refinanced to tap their homes for equity. Many turned into speculative real estate investors. The chart below shows just how loose credit was, with new mortgages by FICO score. Subprime borrowing (orange) totaled $3.1 trillion from 2003-2007. That is more than all the years since.

All this housing activity put upward pressure on prices, creating a positive feedback loop with immense profit incentives for all involved – and a bubble formed. From the dot-com crash in 2001 through 2006, home prices rose by 85% (black line in chart). Homebuilders were having a heyday and the homebuilder stock index returned more than 500%!

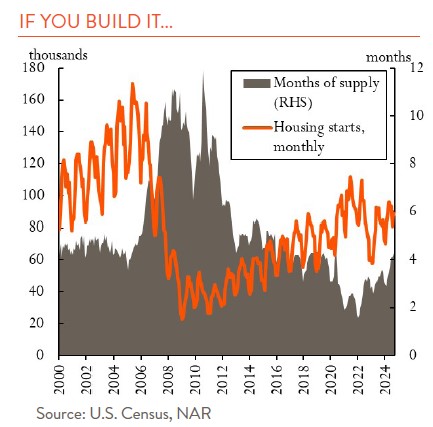

Usually if there is that much money to be made on a thing, the incentive is to make more of that thing. And we did. The figure at the bottom shows new private housing construction starts (orange), just for single-family homes, climbing to over 170,000 per month at its peak in the summer of 2005. There were 3.2 million houses begun over 2005 and 2006 alone—that is a new home for 3%-4% of the entire population.

That all worked out great until the music stopped. Fundamental demand did not support that much housing. Banks “learned” that a lot of their mortgage credits were bad. Home prices sunk. Vacancies shot up. At its worst there was 12 months’ worth of supply sitting on the market.

How did it get that bad? The first culprit was probably human behavior: greed and fear and the sadly predictable cycle of high profits attracting more profit-seekers who eventually overextended themselves. Housing also has some characteristics that amplify that cycle. For one, we do not know the market price of homes in real time like we do stocks. There also is a long lag between breaking ground and completion, which means homebuilders often do not get timely signals to slow building.

But then there was the second half of the human cycle: the reckoning and then overcorrection that led to a decade of under-building. That is where we are now. It seems we are always fighting the last crisis.