Used car buyers have received an unwelcome crash course in supply and demand over the last two years. As new car production cratered, consumers flush with cash and low-cost financing looked to the used market as an acceptable substitute, pushing prices through the roof. With new car inventory inching up, and higher financing rates poised to weigh on demand, can we expect used car prices to drop significantly anytime soon?

Unlike in 2021 when prices surged, the average retail price of a used car has remained around $28,000 for most of 2022. Unfortunately, this still represents a 35% increase from before the pandemic. With new car prices up roughly 21% during the same period, it’s clear that the pricing relationship between the two is out of line.

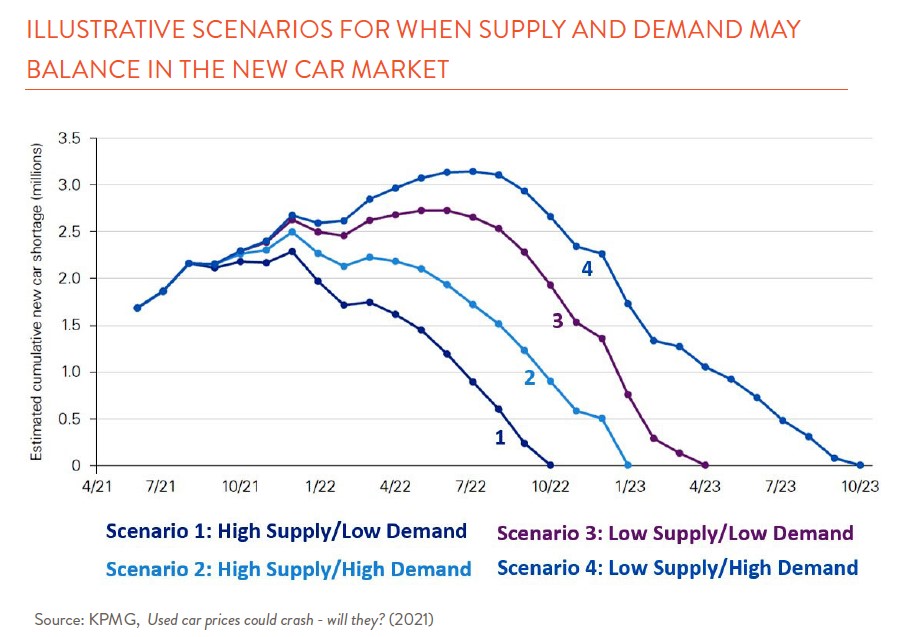

Before Covid, roughly one-third of buyers bought their cars new (around 17 million per year). Satisfying new car buyers with the models they seek will be crucial to taking the pressure off used car prices. In a late 2021 analysis, consultants at KPMG outlined four scenarios for how and when supply and demand for new cars might come into balance, paving the way for used car prices to normalize (see graph).

Unfortunately, it’s safe to say that both high supply scenarios put forth by KPMG (1 and 2) have already passed us by, as these assumed normal auto production would be restored by early in 2022. North American car production for all of 2022 is projected to fall around 3 million cars short, and even though the number of available new cars in August was up over 30% from last year, inventories were only a third of what they were before the pandemic.

With new car prices rising over 2022, even in the face of higher interest rates, it’s also hard to argue that we’ve followed the low demand trajectory (3) that would see things normalize six months from now. Where we sit now is far from normal. Though available new cars are moving a little more slowly off lots, they’re still gone in half the time compared to 2019.

Based on the remaining low supply/high demand scenario (4) for new cars, is it unrealistic to think we might see significantly lower used car prices a year from now?

The supply outlook for new cars doesn’t appear to support this. The major constraint continues to be the availability of lower tech semiconductors, found in everything from electric windows to airbags. Early in the pandemic, car manufacturers canceled orders and were unable to get back in line as foundries prioritized higher margin chips used by cell phones and PCs. Though current impacts vary by company, it’s now estimated that chip shortages will last at least until the end of 2023. The mix of cars being produced is changing as well, with luxury brands reporting fewer chip constraints and many non-luxury companies putting available chips into their most expensive models.

Changes in new car demand could also continue to disadvantage used car buyers. As new car shoppers face higher financing rates (5.7% on average, and expected to climb) and a supply that’s skewed toward higher end cars, they might increasingly turn to the used market for relief. New car buyers have upped both the size and length of their loans, which points to issues of underlying affordability. We’ve already seen evidence of consumers being pushed down market, as some of the highest price increases over the last two years hit used cars over 10 years old. Though the move to used cars could pressure new car sellers to lower prices, it could take some time as prices tend to be stickier going up than coming down.

The takeaway? While prices may moderate in the year ahead, we don’t expect bargains to appear. Plan to put off buying a used car until 2024 if you can. With inflated prices and high rates, even large repairs to an existing vehicle could make financial sense. A small silver lining? According to AAA, most cars today stand a good chance of making it to 200,000 miles.