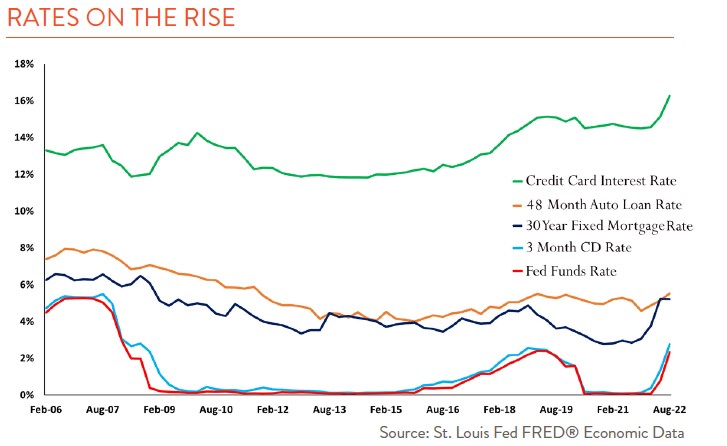

Inflation is high, currently at levels not seen in over four decades. The Fed’s target for inflation to ensure balanced growth in the economy is 2%. Much like Icarus, inflation is soaring way too close to the sun for the Fed to feel comfortable about our economic outlook, and they are moving aggressively to fix it.

The most influential tool the Fed has is the control of short-term interest rates. When inflation is too high, like it is today, interest rates increase to encourage individuals and businesses to change financial habits, essentially prioritizing savings over borrowing.

So, while the Fed is using rates to bring inflation down, what are some smart personal financial decisions you can make now as rates increase? Here we’ll focus on how rates impact your savings and the rate you’ll pay to borrow money.

Interest rates have been at near historic lows for the past 15 years. While low rates have fueled a strong stock market, they have also meant an anemic reward for those looking to save in short-term liquid investments. The days of earning a respectable return on your safe investments are back!

Here are some tenets of personal finance that should always be followed, especially now that interest rates are higher.

The first is an emergency fund. Everybody should strive to have three to six months’ worth of expenses in a separate account reserved for those rainy days. Keep this money in an account not linked to your daily money management needs to decrease the temptation to use it for non-emergency purposes.

Furthermore, if you take regular distributions from your investment accounts, it is prudent to have enough on hand to cover 12 to 24 months of distributions.

Building cash for these two purposes is especially relevant given that the probability of recession in the coming year is increasing. We are not saying a recession is guaranteed but rather we recommend proper preparation. Having safe and liquid assets to get you through potentially difficult times allows longer-term investments (stocks) time to recover while ensuring your short-term cash flow needs are met.

Shop around because not all bank rates are equal. For example, a recent study by nerdwallet.com showed that the average one-year CD offered by a traditional bank was 0.71%, whereas the average one-year CD rate at an online bank was 4.00%. A similar pattern can be seen between rates on savings accounts. So, think outside the bank and know your options.

Also consider a laddered CD or Treasury strategy. You can structure a chunk of money to mature every three months for instance. You can then decide to spend the proceeds or reinvest back into the ladder. This approach gives you the control of a predefined maturity schedule, while earning over 4% on your safe investments.

Now that you are saving more, it’s time to talk debt. The same forces at work earning you more on savings are also driving up the cost of debt.

According to the Mortgage News Daily Index, last year the average 30-year mortgage rate was 3.07%. Fast forward to today and that rate stands at 7.21%. To put this in perspective, a $500,000 loan last year would cost you $2,126 per month (principal and interest). Today that same loan means a payment of around $3,397 or an increase of 60%!

It’s been well documented that cars are more difficult to find today, and cost more. The issue is made worse when financing is required. Much like mortgage rates, the cost to finance has increased substantially over the past year. Unless you absolutely need a new vehicle, it’s best not to chase limited inventory and increased finance charges today.

And consider paying off credit cards. Most cards have a variable APR, meaning your rate will go up as the Fed raises rates. According to bankrate.com, the average credit card balance is around $5,500. We advise not carrying a credit card balance past the grace period and signing up for autopay to pay off your balance completely each month, ensuring you pay 0% interest. This matters because, according to creditcards.com, the average credit card rate is 18.94% — Ouch!

The suggestions here might all seem sensible and obvious, but most people today are not shopping for rates on short-term investments, and many continue to justify incurring debt when making large purchases. The world has changed with rising interest rates. Time to pay attention.