This is one of those times. The invasion of Ukraine has produced horrors on the ground, a refugee crisis of one to two million Ukrainians fleeing to neighboring countries (and counting), and a response by the West that has been both strong and unified. Not only have Western Europe and the U.S. put lockdown restrictions on the Russian economy, but historically neutral countries like Finland, Sweden, and Switzerland have also joined in.

We are now in a contest of endurance both militarily, for Russia and Ukraine, and economically. Who will blink first from the pain of the sanctions — Putin, the oligarchs, and the Russian people — or the West, which will suffer higher oil prices and worsening inflation?

The sanctions are also causing unintended consequences. For instance, what is the future of the dollar after sanctions, and what is the future of the world financial system, presently controlled by the U.S. and the West? The dollar is the world’s reserve currency. Sixty percent of Central Bank reserves are held in dollar-based assets and most global trade is conducted in dollars. My wife exports furniture textiles from China to Eastern Europe (not Ukraine or Russia, however). Importers in Europe convert Euros to dollars to pay factories in China. The factories in turn convert dollars to yuan to pay suppliers and workers. The dollar is the linchpin of globalization.

But will this always be? Once you cut an economy off from the dollar (Russia), other countries (China) get worried that they may be next. They start looking for alternatives. Even Fed Chairman Powell has admitted there may eventually be more than one reserve currency.

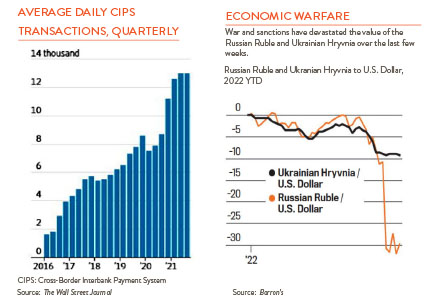

Current sanctions have cut Russia and its banks off from the SWIFT system, the West’s messaging platform for global financial transactions. Sanctions have frozen a big part (maybe 50%) of Russia’s $600 billion currency reserves, but they also have caused more mundane problems. When a Russian tourist in Thailand tries to withdraw funds from a Russian checking account using a Thai bank’s ATM – it doesn’t work anymore.

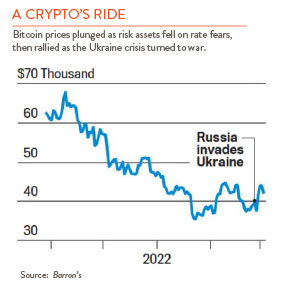

Cryptocurrency adoption is another issue in the news today. If Russians and others cannot get dollars or transfer assets outside the country, crypto could be the answer. The promise of crypto has always been that two people with an internet connection anywhere in the world can transfer funds to each other quickly without any middleman. Since the Ukraine invasion crypto trading has increased dramatically.

What do we think about the dollar’s possible loss of influence and crypto adoption? Maybe in the long run, but not anytime soon. Crypto has a decentralized appeal, but it is still very much a “Wild West” market. Prices fluctuate dramatically, and hacks and scams have been common. As for the dollar, the Chinese homegrown SWIFT-like messaging system (CIPS) may eventually be a factor, but don’t hold your breath. The yuan is still not convertible, the banking system is very much state controlled, and the country has no true rule of law.