The Social Security Trustees recently released their Annual Report August 31, which warned that the Social Security Reserve Fund would run out of money by 2033, one year earlier than previously projected. Social Security is paid from two sources: First from FICA payroll taxes, the 7.65% of gross pay paid by both employees and employers. Not all the FICA revenues goes to paying Social Security, however. Part goes to cover Medicare.

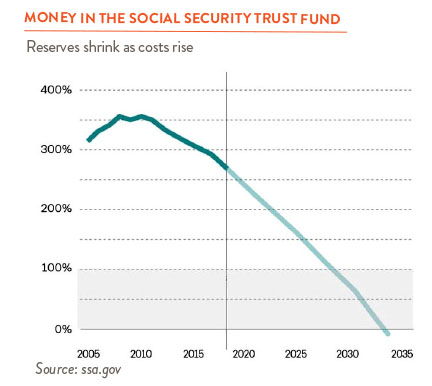

The second contributor to Social Security payments is the Social Security Trust fund. This is the fund which is running out of money (see below). In 2033, if the Trust fund does indeed go broke, Social Security payments will be reduced by approximately 20-25%.

This is the bad news. The good news is it will almost certainly be fixed. Social Security is just too important to too many Americans. But fixing Social Security requires a certain amount of pain, and Washington does not do well with pain. It is much more comfortable kicking the can down the road. A fix to Social Security will probably not come until the cliff edge is precariously close in sight.

How do you fix Social Security? You either raise taxes or reduce benefits or a combination of both. Remember I said fixes require pain. It’s estimated that if you raised the 7.65% payroll tax by 1.6% for both employers and employees you would solve the problem for 75 years. 1.6% doesn’t sound like a big number, but it is a 20%+ increase in total FICA taxes and a reduction in take-home pay. Another option is to increase the amount of current wages subject to the payroll tax. Currently, this is $142,800. A final option is to reduce future benefits by changing the inflation adjustment to annual Social Security payments. This keeps the system solvent longer.

The whole Social Security “cliffhanger” is perhaps a good wake-up call. We need to take control of what we can control and not wait for Washington to decide on Social Security. Social Security is an important factor in retirement planning, but it is just one. Social Security is estimated to replace about 55% of lower income Americans’ pre-retirement income. That still leaves a lot to cover. And higher income Americans are less dependent on Social Security.

We need to save as much as we can as early as we can, and we need to think about retiring later if that is a possibility, physically and/or psychologically. Most Americans working today reach “full” Social Security retirement at age 67 but they can take Social Security as early as 62. The difference in benefits between taking them at the earliest possible time and the latest (age 70) is 76%. This is a big number especially since your initial Social Security benefit (plus annual inflation adjustments) stays with you the rest of your life.