In the spirit of transparency, it’s time to “fess up” to things we whiffed on in the past. First up, Globalization. With the publishing of Thomas Friedman’s The Lexus and the Olive Tree in 1999, globalization became a force of nature, impossible to stop and beneficial for everyone. Ugh, we got that wrong. Today globalization is in the doghouse. The U.S. has lost tons of jobs to lower cost global economies and the idea that shared economic interest would stop wars sure didn’t pan out (think Ukraine).

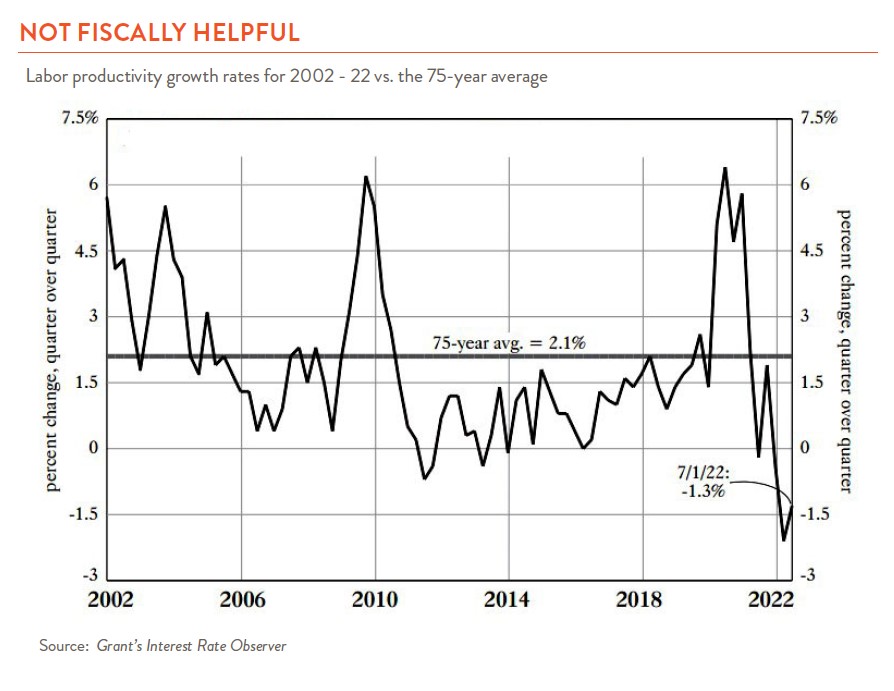

We also got productivity wrong. If you have a growing workforce and those workers are producing more per hour, you are going to have a naturally rising economy. With all the fancy technology we were investing in, productivity was sure to take off. Wrong again. For most of the 2000s productivity floundered. Maybe AI will be the savior, but for now, our bet on productivity is not a winner.

Our third whiff was the 1990s excitement about emerging markets. EM was where the majority of the world’s population was. This was where the exciting markets of China, India, Brazil, etc. were. Growth was going to be dynamic, so you had better jump on board. Well, results have not really panned out. Over the past 30 years, the average gain for emerging markets has been 5.35%, not bad but only about one half the U.S. gain.

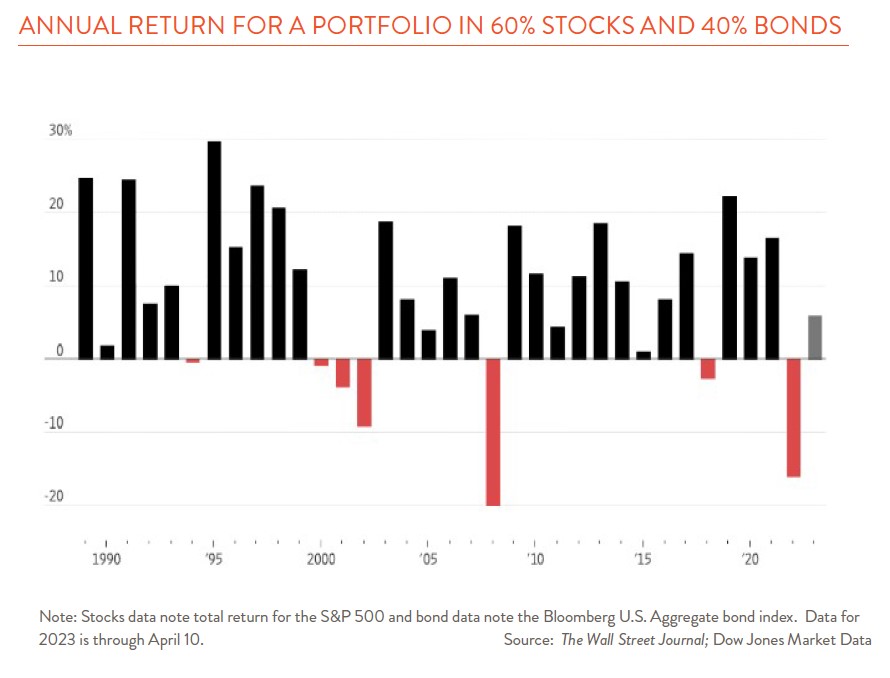

Three strikes on three big issues. You would think we are headed back to the minors. Hardly. We got one big thing right over the years and that made all the difference. We stayed fully invested in a diversified portfolio of stocks, or in the case of clients who needed to be more conservative, a portfolio of stocks and bonds. Over the last 30 years, U.S. stocks returned an average of just under 10% per year, and a 60/40 stock and bond mix was very close behind. So what about the future? Pretty simple. Don’t worry about your big macro mistakes. Just stay fully invested, stay fully diversified, stay calm, stay patient, and “get rich slowly.”