Founders of behavioral economics, Daniel Kahneman and his long-time collaborator, Amos Tversky, developed a new understanding of how we make decisions. Despite being a psychologist, Kahneman won the Nobel Prize in Economics for the contributions and challenges that his work on “human judgement and decision-making under uncertainty” made to the field.

Classical economics considers humans “rational agents” who carefully weigh the costs and benefits of all their options and choose the best one. Kahneman and Tversky showed that this model does not actually fit human behavior and that decision-making is often influenced by factors beyond cost and benefit.

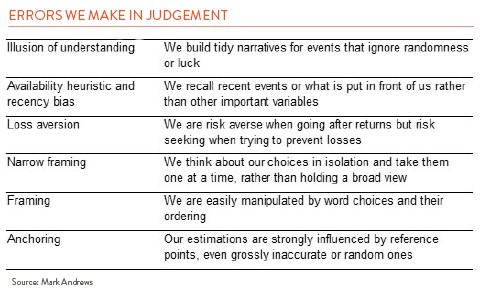

In his 2011 book, Thinking, Fast and Slow, Kahneman attributes much of the less-than-rational behavior to the two systems we use for decision-making. Thinking fast happens automatically, and it is intuitive, impulsive, biased, and often wrong. Slow thinking uses a lot of energy, and it is logical, critical, and capable of checking our intuitive errors. The book lays out many of the mistakes in decision-making that arise from thinking fast (see table for a sample).

For investors, understanding how these pitfalls cloud our judgement and training ourselves to engage our slower-thinking system is crucial.

Take for instance, the “Illusion of Understanding,” or how humans like to tell tidy stories with facile explanations that attribute too much to skill or incompetence when luck also plays a large role. We connect the dots with “Action A led to Result B” to fit everything together neatly, but this tendency can lead us astray.

For example, consider the hot topic of Google’s recent “failed” reveal of its AI chatbot, Bard. In case you missed it, Google rushed a public release of Bard in response to the hype around rival Microsoft’s investment in OpenAI’s ChatGPT. Unfortunately, Bard made a factual error during a live demo, which set off big headlines – and our fast-thinking brain. We built a narrative of failure for Google and how far behind it had fallen versus Microsoft. This easy-to-grasp story informed our view of the future of Alphabet, Google’s parent, which immediately lost $100 billion in stock market value.

Now get your slow-thinking brain involved. Was the demo a referendum on Google’s prospects? Was it bad luck that the error was exposed during a very public demonstration? ChatGPT makes plenty of errors too.

As long-term investors, we need to evaluate the new information and determine if it changed our thesis about Alphabet. Whether our views change or not, it is important to be aware of the Illusion of Understanding, and slow down.

Another mistake we make is the “availability heuristic,” or the tendency to see an issue only in the terms presented to us. Continuing the AI example, I imagine many of us started seeing the problem of “AI Chatbots and the Future of Search” in terms of Google vs. Microsoft. We could spend most of our energy evaluating the merits of each company but ignore other potentially relevant variables (e.g. other advanced AI chatbots, like Baidu’s Ernie). Maybe Google vs. Microsoft is the right framing. Or maybe this is like 2006, when we all were analyzing Nokia vs. Motorola for the future of cell phones while ignoring Apple.

Kahneman says he is still prone to fast-thinking mistakes, but concludes, “I have improved only in my ability to recognize the situations in which errors are more likely.”

In the investment process, it is important to learn to do the same.