SPOILER ALERT: I cannot add anything meaningful to what is being reported by the Western press on the Chinese economy. But I can confirm what is being said. Business is weak, the manufacturing index is down, exports are lagging, and private investment has declined by a quarter since 2020.

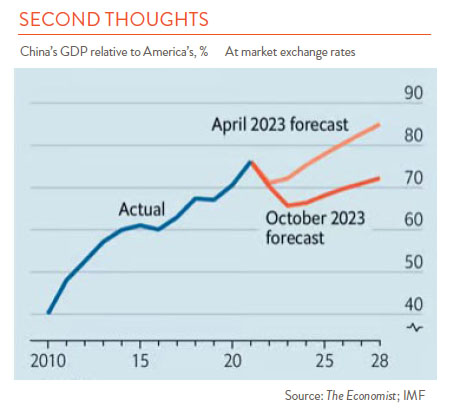

There are two important things to watch in China today. First, Xi Jinping is not a believer in free markets or the Western model. “The East is rising, and the West is declining,” he has said. The Chinese studied the collapse of the Soviet Union and a big reason for it, they feel, is that the Soviets’ “ideals and beliefs wavered.” Xi has doubled down on Communist party authority. He has put State-owned companies ahead of the private sector, and he has reined in the power of private sector business execs like Jack Ma. No executive or administrator wants to say or do anything today for fear of retribution. The longer Xi keeps his foot down on this issue the less likely it is China will surpass the U.S. (see chart).

Second, the apartment glut is an enormous economic overhang. The Week estimates there are 80 million apartments that are either unoccupied or paid for but not yet completed. How long it takes to digest all this construction is the big question. Will the apartment overhang be absorbed naturally by the market in short order? Or will the government let a painful collapse occur followed by a recovery like our 2008 housing bubble? Or will it be slow and torturous like Japan, which has gone decades with subpar growth? Or finally, will there be an enormous collapse that no one can contain? Stay tuned.

Compared to 20 years ago, pollution along the China coast is much improved. We had to go inland past Nanjing to see bad pollution. But in the agricultural areas west of Nanjing and the coal country of Shanxi and Shaanxi (see coal truck picture) it can be very bad. We saw many wind towers operating, which is a good sign, but China still gets 60% of its electricity from coal, and new coal plants are still being built. It will be a long time before China weans itself off low-cost, easy-to-dig coal.

Finally, a note on tourism. One of the biggest surprises this trip is there were no foreigners in China. No foreigners! We might have seen one or two or three a day, and we were in many big tourist areas, including Nanjing, Xi’An, and the Yungang Caves at Datong. The good news for the tourist industry is that Chinese tourists are travelling in large numbers again, back to pre-2019 levels, but this means many tourist areas are swamped with people.

Travel tip: China has developed a number of chains of inexpensive hotels ($50-$100 a night) that are clean, comfortable, and generally include breakfast. Our recommendation is to check out the “Atour” chain.

And finally, my no-fail test of economic development. I grew up in many developing countries where the big question was, could you find a clean bathroom? The Hanson indicator of economic development is pretty simple. If the bathroom is clean, the economy is developed. In China on this trip, we did not find a single bathroom that was not clean!