Old habits die hard, they say, and so it is that investors have struggled to let go of the playbook that triumphed the past decade. Buying the dip in big tech and old favorites worked great in the benign, low-volatility bull markets we had for over a decade. But not this year. Nothing has snapped back quickly or easily, and that has put us in unfamiliar territory. As Dorothy said in Oz, “Toto, I’ve a feeling we’re not in Kansas anymore.”

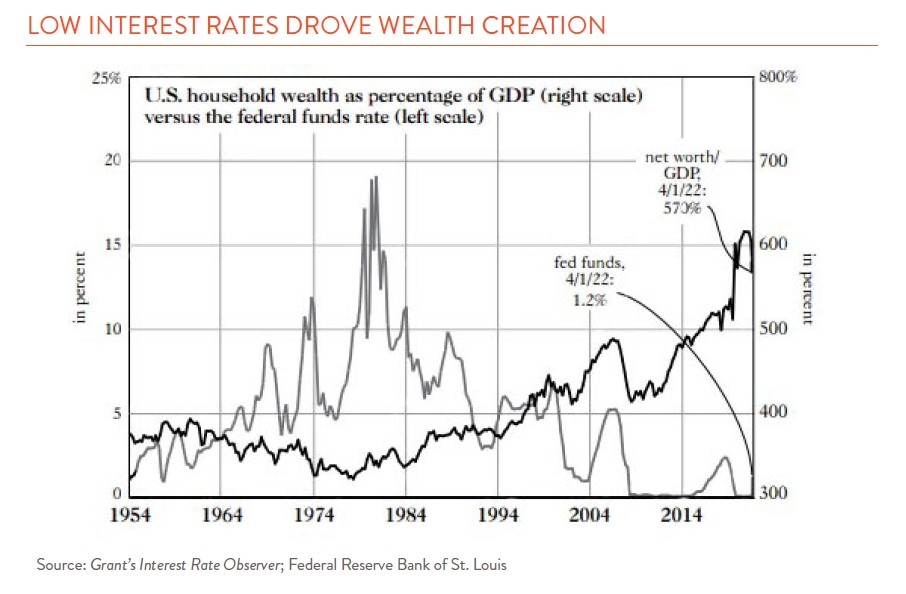

For a long time, investors had the wind at their backs. We had cheap energy, cheap labor (thank you, China), geopolitical stability, and a U.S. regulatory environment perfectly calibrated, almost exclusively, to generating amazing corporate profits. Of course, above all, we had cheap money, and as the chart above shows, low interest rates turbocharged household wealth for a decade. We felt rich. Whether the wealth was real or not, it was an era, as bemused FT columnist Sarah O’Connor recently wrote, where flush investors subsidized her cheap Uber rides and 15-minute deliveries of chocolate and beer from Getir.

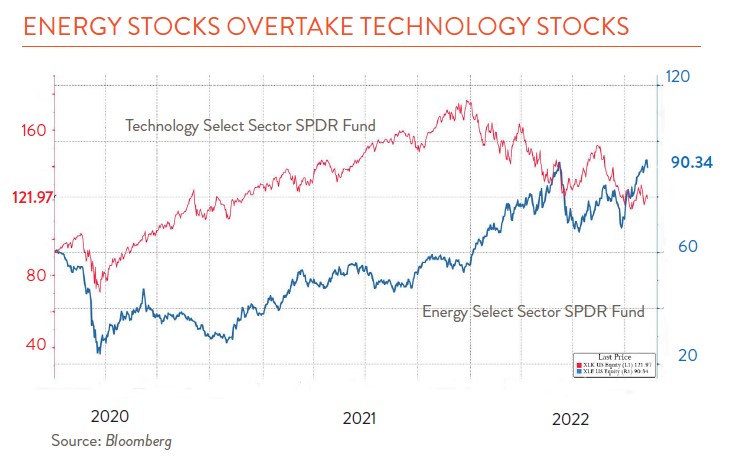

But all that is over. Covid, then war, mucked up supply chains. Inflation went sky high. National security, energy security, and semiconductor security all got intertwined. And reviled energy stocks started topping beloved tech (see chart below).

Aswath Damodaran just wrote a long post on Meta — a mega-META writeup, if you will – where he pointed out that buying Facebook on its first trading day in 2012 at $38 and holding through the end of October at $93 made 144%. That is good, but less than the 181% the S&P 500 made over the same time — and that doesn’t consider the S&P 500’s 2% dividend yield.

So how do you invest when you’re not in Kansas anymore? For one thing, don’t reflexively buy the dip. Investing is going to be a little harder and require some old-fashioned hard work. But the good news is that there are ample opportunities ahead.

One thing we’re excited about is that many fine companies will finally get their due as markets refocus on fundamentals like cash flow. We no longer have the tide of low rates lifting all boats, which means that valuation matters again. And while passive indexing remains a sensible strategy for many, opportunities to actively select individual securities look better than they have for years.

We believe there will be plenty of technology among the winners of the future – but perhaps not from the tech sector alone. Smart users of tech, not just makers, could be some of the most exciting companies ahead. Industrials and energy producers – both conventional and renewable – will be among the most tech-intensive. In fact, every company will become a tech company, and those that can better manage enduring supply and labor constraints should generate more cash.