When it comes to financial planning, no matter what the world throws at us, some questions remain constant. How do I manage my day-to-day finances? How do I prepare for the future? And, perhaps most importantly, how do I deal with life’s curveballs?

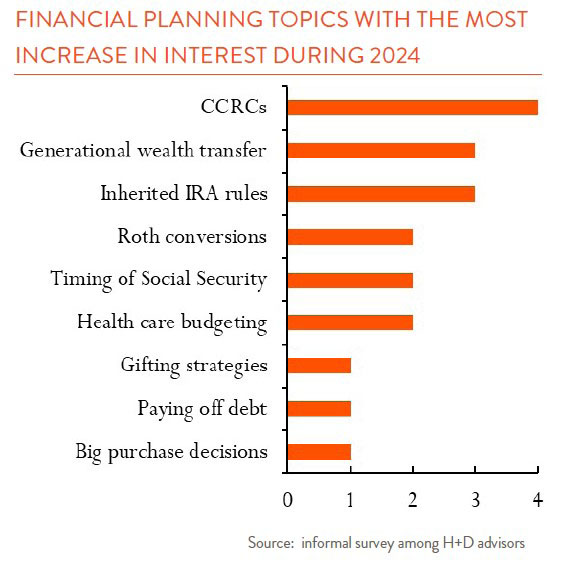

Sometimes, other topics bubble up, depending on the year, the market, or shifting legislation. The chart to the right shows what our advisors singled out for these “trending” topics in 2024. We’ll dive into the top three here: Continuing Care Retirement Communities (CCRCs), involving the next generation in financial planning, and rule changes to Inherited IRAs.

Continuing Care Retirement Communities (CCRCs)

CCRCs are like a one-stop-shop for aging. These communities offer a range of living options, from independent living to skilled nursing and memory care, all within the same campus. The appeal is the assurance that as healthcare needs evolve, residents will have the care they need. In many ways, a CCRC functions like long-term care insurance – offering a predictable, comprehensive solution for aging. Here are a few things to think about:

Know the costs: A standard “Type-A” contract requires a large upfront payment, often funded by the equity in your home, followed by a monthly fee. The monthly fees cover not just your living space and some meals, but the access to care as your needs change. Make sure to understand exactly what type of contract you are signing and how it fits into your budget.

Understand which of your expenses are reduced: Many of the costs associated with independent living – like property taxes, utilities, and home maintenance – may go away when you move to a CCRC. This can help offset some of the monthly fees, but be sure to map out your current expenses and understand what you’ll still be responsible for.

Right-sizing your living space: It’s tempting to go for the biggest, flashiest unit when considering a CCRC, but a smaller space may encourage a simpler, more manageable lifestyle, not to mention a reduced monthly expense. No matter the size of your unit, you’ll receive the same level of healthcare services as everyone else. Larger doesn’t always mean better in a CCRC.

Involving the next generation in financial planning

In 2024, we saw more families realize the importance of involving younger generations in financial planning. Historically, financial decisions were made without much input from children or grandchildren, but that’s changing. A common reason for this among clients is their own unfavorable personal experience settling the estate of their parents.

Including younger family members in the conversation ensures they know how family wealth is managed and prepares them to take the reins when the time comes. It also reduces potential conflict or confusion during the transition of assets and teaches them valuable lessons about saving, investing, and managing money – skills they can use for their own financial futures.

New rules for Inherited IRAs

Before the SECURE Act, originally passed in 2019, non-spousal beneficiaries could “stretch” the Required Minimum Distributions (RMDs) over their lifetimes, allowing for long-term growth while minimizing tax. The new law now requires the full balance to be distributed within 10 years following the year the original owner passed – no more stretching.

Enter SECURE Act 2.0. The new rules, effective in 2025, might require non-spousal beneficiaries to start RMDs now AND keep track of making a full distribution by year 10. True to IRS form, the rules are a bit complicated and depend on factors like the age of the

original IRA holder at time of passing and whether they had begun their own RMDs while still living. But the bottom line is this: if you’ve inherited an IRA, now is the time to review how the

new rules impact distributions for your particular situation.