Many investors try to get to Omaha once a year, or at least once in a lifetime, to see Warren Buffett at the Berkshire Hathaway annual meeting. At 94, Buffett still is viewed as one of the greatest investors of all time, and still, he stays on stage for hours spouting truths so simple you wonder why you couldn’t come up with what he just made so obvious.

Of course, you can also watch the big show on television. CNBC has been broadcasting the Berkshire meeting for four years, and at home you can see and hear better than in a cavernous convention center. Plus, you don’t have to wake up before sunrise to queue up in the Omaha chill to compete for a seat – an estimated 40,000 people attended this year.

Still, being in Omaha in person – as I was this year – is different. For one thing, this year was special because it was not only Buffett’s 60th meeting, but also his last as CEO: In a surprise announcement, he ceded his CEO role to Greg Abel, then received a resounding ovation.

For another, being in Omaha is a chance to meet investors from all around the world. I met people from every continent but Antarctica. Many weren’t professional investors but just inspired students of the craft. Others were attorneys, physicists, or engineers hoping to abandon their careers to become professional investors – a testament not just to the attraction of Buffett’s teaching, but also to how competitive investing is. Thousands of smart people are trying very hard to stand out from the crowd.

Buffett’s conversation over the four and a half hours he was onstage spanned currency, tariffs, Japan, nuclear proliferation, the electric grid, and much more. But the theme that left the biggest impression on me was “turn the page,” Buffett’s phrase for digging deep into every corner in pursuit of ideas.

Those who have studied Buffett know his relentlessness – the way he pored through the Moody’s Manual and annual reports, committing numbers to memory. Buffett could memorize whole passages and case studies from Benjamin Graham and David Dodd’s Security Analysis, then recite them back to Dodd in class while a student at Columbia. One Saturday in 1951, after reading about GEICO, Buffett jumped on the train to Washington, D.C. and banged on the doors of company headquarters. A janitor eventually let him in, and he got to spend several hours with future GEICO CEO Lorimer Davidson, who happened to be working that Saturday. That is turning every page.

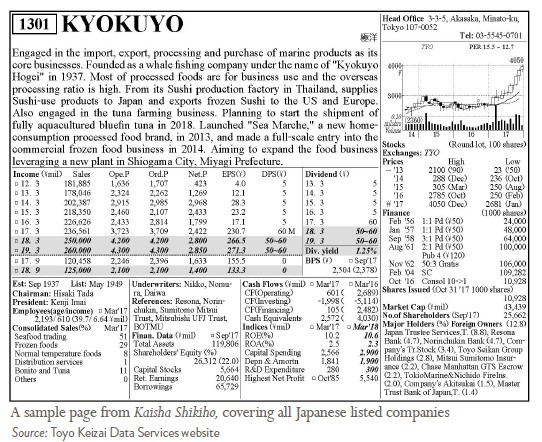

This year, Buffett said he bought into the Japanese trading companies in 2019 after going through a thick manual of two or three thousand Japanese companies and discovering “these five trading companies selling at ridiculously low prices.” (He’s referring to Kaisha Shikiho, which covers all of Japan’s listed companies). “It’s amazing what you can find when you just turn the page,” Buffett said – yet so few investors do. And those who do “aren’t going to tell you what they’re finding.” You must do the work yourself.

I’d also be remiss not to mention Buffett’s life advice. Both Buffett and his late partner Charlie Munger always had plenty to share on this front. Munger’s three rules were to never sell anything you wouldn’t buy, never work for anyone you don’t respect, and never work with people you don’t like. But Buffett always has been softer: Just try to associate “with people that are better than you are,” he advised, so that you naturally float upwards. You may not find the right people right away, but that’s okay. “When you find them,” he said, “you treasure them, and when you don’t find them, you still keep doing whatever enables you to eat. But you don’t give up on looking around, and you will find people who do wonderful things for you.” Help others along the way too, and “you get a compounding of good intentions and good behavior.”

And perhaps that is the real takeaway for most of us – because the truth is that few will ever get anywhere close to what Buffett did as an investor. Nevertheless, we all can learn from the way he has lived. He knew what he wanted early on, he set up his life to do the work he loved, and he stuck to his principles – a life well lived indeed.