Those of us of a certain age will remember “CliffsNotes,” the condensed study notes that saved a lot of procrastinating students from academic purgatory. I still have never read War and Peace, but the CliffsNotes were great!

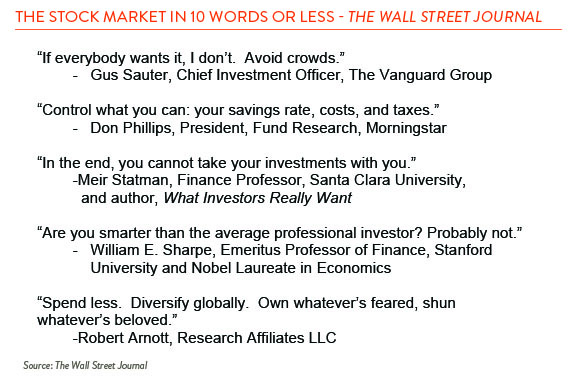

Back in 2012, Jason Zweig, the excellent columnist in The Wall Street Journal, came up with the idea of asking five investment gurus for the “secret to success,” but instead of requesting 300 pages of single-spaced typing he said, give it to me in 10 words. Shown below are the results. The wisdom 10 years ago is still good advice today. There is an emphasis on being contrary (if everyone wants it, avoid it), an emphasis on controlling what you can control (costs and taxes), and an emphasis on psychology and emotions (you can’t take it with you).

The one piece of wisdom I would question is, do you really think you are smarter than the average professional investor? Due to the extreme emphasis on short-term performance today and the pressure to beat the S&P 500, the professional investor is often the poster child for herd mentality. He jumps from the unpopular to the popular at the first sign of underperformance. Individual investors have only themselves to answer to and can be more patient and more long- term. At least in theory. There will always be the day traders and those wrapped up in the emotions of the moment, but sensible, long-term individuals often outperform the professionals.

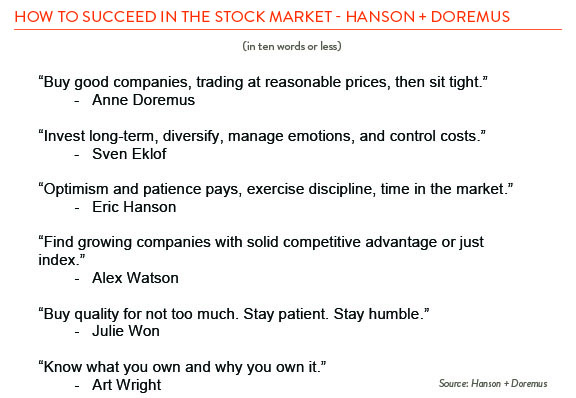

I thought it would be a good exercise to ask those of us here to put down our thoughts – 10 words or less – on how to be a successful investor. The quotes above are a good reflection of how we manage money. We prize doing our own independent research. We look for quality companies which have a competitive advantage – but which are selling at reasonable prices. We also emphasize long-term investing, letting time in the market play out to our advantage. And finally, we recognize the need to stay patient even as the waterfall of daily information pressures us to panic and overreact.

The best definition of Wall Street I know of is, “The stock market is only indirectly related to economics. It is a reflection of human fear, greed and apprehension, all overlaid on a business cycle.” We try here to balance the fundamentals of investment markets with the psychological and the emotional.