And I hope I am very much wrong. I am worried that today’s economy is like the period 1965-1982. Back then the economy was overheating from the costs of the Vietnam War and Great Society social spending. Congress was unwilling to raise taxes to cool the economy, and the Federal Reserve was in a classic dilemma. If it stepped on the brakes too hard to lower inflation it would worsen unemployment. But if it tried to boost the economy and employment it would simply worsen inflation. A Scylla and Charybdis world — stagnant growth and galloping inflation all at the same time.

How did we get out of that mess? Jimmy Carter appointed the cigar chomping Paul Volcker as the new Fed Chief in 1979. His choice was to tackle inflation head on, suffer the ensuing recessions and get the economy back on track. He was successful. Interest rates went up dramatically — 10%, 15%, and eventually even higher. The economy suffered two sharp, quick recessions, but the stage was set for an almost 40-year period of low inflation and declining interest rates.

Today inflation has soared to over 9% on an annual basis. The unprecedented Covid stimulus spending is a big reason, but other factors such as global supply chain dysfunction and rising oil and food prices have made this a worldwide problem.

The Fed has a tough assignment today, similar to the 1970s. They want to get inflation back down to 2%-3%, but the economy is fragile, close to stall speed and maybe even in recession. The Fed has been cautious so far. They do not see inflation so firmly entrenched that they need to take Volcker-esque action. They have been more measured in their interest rate increases, hoping prices will recede while at the same time keeping the teetering economy in one piece.

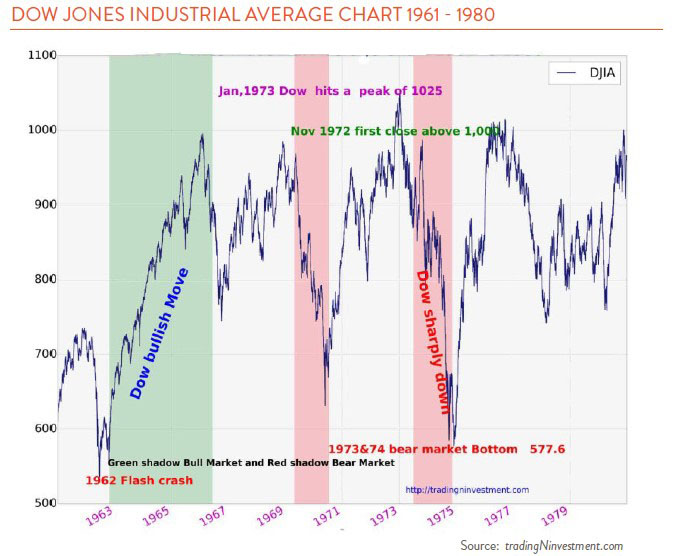

We are holding our breath that they are right. But if the inflation genie à la the 1970s is out of the bottle, stronger medicine is called for. The one thing we do know is that the 1970s economy was not good for stocks. Over the 10 years, from 1970 to1980, the Dow Jones yo-yoed up and then down and ended the period about where it started (see chart above). We hope Mr. Powell has studied the lessons of the 1970s and is prepared to act boldly if current steps are inadequate.