The Trump administration’s policy actions over the last few weeks have dented confidence in both the U.S. economy and the stock market. This shift towards negativity happened despite President Trump largely sticking to his campaign pledges to implement tariffs and cut government spending. So what has changed since the election to cause the widespread turn towards pessimism?

At the start of the year, the economy appeared poised for solid growth, carrying over from a strong 2024. The IMF’s World Economic Outlook forecast U.S. GDP growth at 2.7% for 2025 in its January update, and projected the U.S. would outgrow all the other G7 advanced economies. Forecasters expected the stock market to grow as well, albeit at a much slower level than the previous two years, which saw 20%+ annual growth. In December, Reuters reported major Wall Street banks forecasting 7%-15% gains for the S&P 500. Their optimism was driven by expectations that the second Trump administration would start in the same manner as the first, by cutting taxes and lowering regulatory barriers, thus sparking growth.

However, the view from ground level on the economy has been less rosy, even prior to the start of the new administration. Concerns among consumers were widespread during the presidential election, with inflation at the forefront of many voters’ minds. Those concerns remain pervasive as the prices of many consumer goods continue to rise. The Conference Board’s Consumer Confidence Index began to fall in December and slid further in January and February, with short-term expectations now below the threshold that signals recession.

What happened? On the consumer side, data seem to have finally caught up with sentiment. After the latest Personal Consumption Expenditures (PCE) report, the Atlanta Fed’s GDPNow forecasts almost no contribution to Q1 2025 GDP from consumer spending. And driving the forecast firmly into negative growth territory are expectations for imports and exports. Which brings us to Trump 2.0.

While the administration has held firm on its promises, the implementation has been more volatile than many forecasters expected. The tariffs seem to be raised, dropped, or paused daily, and the target countries are retaliating faster than expected. The efficiency drive appears to cut deeper into essential services and to include more job cuts than expected. Instead of centering on tax cuts and deregulation, as Wall Street wanted, the focus appears to be on trade wars and severely slashing the size and scope of the government.

On top of the relatively unpredictable policy shifts and deeper cuts, the President and his advisors have doubled down on the concept that America needs to undergo a transition period “to rebuild the country.” Treasury Secretary Scott Bessent claims that the U.S. will undergo a “detox” period to wean itself off its government spending addiction. Trump also refused to rule out the possibility of a recession in recent comments. While the President and his advisors may walk back some of the pessimistic rhetoric, the market and forecasters have already been spooked.

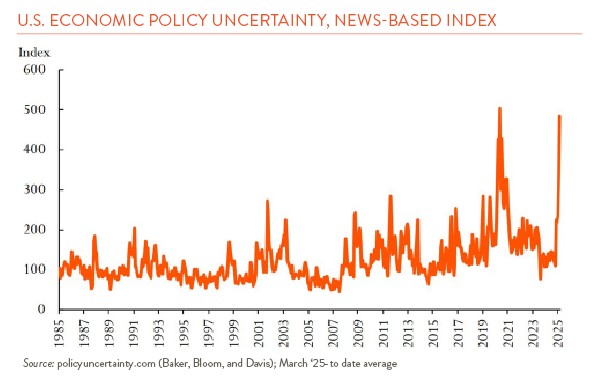

All this has contributed to elevated levels of economic policy uncertainty, which is anathema to investors and businesses (and equity markets). The chart below shows a marked spike in an index tracking the volume of news discussing economic policy uncertainty from major outlets – though this may say as much about the evolution of news media and the “attention” economy as it does about actual policy uncertainty.

What’s to be done? An unsatisfying answer may be: not much, yet. While forecasters are coming around to the view that policy changes might hurt and the till-now-resilient consumer may be rolling over, the truth is, we do not know. And when we can’t see the path forward, it behooves us not to make any sudden moves. Instead, we recommend that portfolios be set up as well as possible for the long term to weather the inevitable storms that periodically arise.