I have always been interested in money, not from the standpoint of what it can buy or how we can use it to invest, but from the standpoint of psychology. Money is the ultimate confidence game. The dollar is not backed by anything today. It is worth what it will buy, and we are confident in it as long as we think others are confident in it.

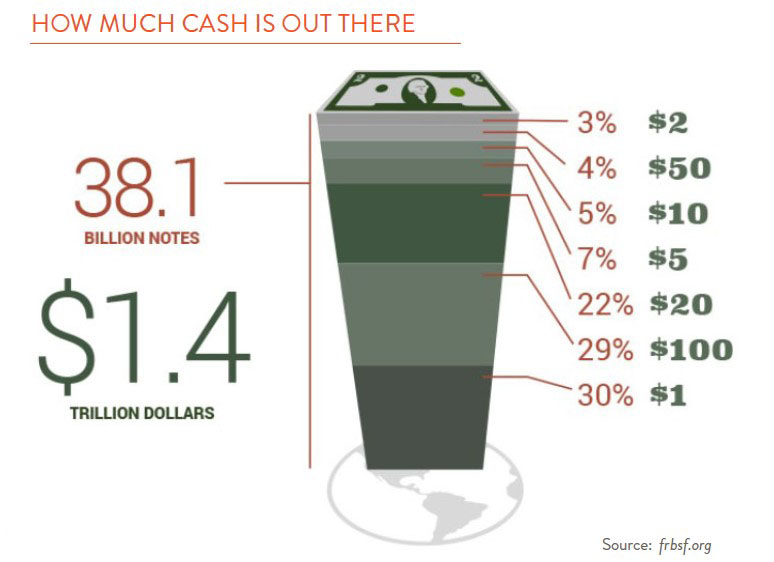

The chart to the right shows the number of dollar bills in circulation and the total value of those bills. I apologize that the chart is a bit dated, from 2016. The total value of bills in circulation today is $2.2 trillion, up from $1.4 trillion in 2016. And the number of $100 bills is now much greater than the number of one-dollar bills. Back in 2016, they were about equal. The dollar is the world’s #1 currency, and it is estimated that 70% of the value of all dollars are held outside the U.S. It is also estimated that most of the $100 bills are offshore. I rarely see a $100 bill used here, but outside the country it is much more common to see it in transactions.

The use of currency in general is in gradual decline today. Sweden is the extreme case. Many banks no longer have cash on site. Everyone uses plastic or cellphone apps. The same goes for China where two private apps, Alibaba (Alipay) and Tencent (Tenpay), use cellphone QR codes linked to funds on deposit to make payments.

Here in the U.S. many older people prefer using cash, but overall only 18% of Americans now favor paying in cash versus 27% in 2016. New York State was concerned enough recently to legislate that retail establishments had to accept cash in addition to plastic, or face a fine.

Other traditional transaction methods are also in decline. Checks seem to be the dinosaur of finance today. Who even knows what the numbers at the bottom of a check mean? (Hint: the 9-digit number bottom left is the bank routing number; the next number is your account number. You’re welcome).

So, what is next for money? Some think it might be crypto, which is not corrupted by government control and is protected by blockchain. But after 15 years, crypto has still not proven itself as a medium of exchange (i.e., where can you use it?), and it certainly is not a store of value. It can bounce up or down 50% in just a few months.

The future of money, I think, may be a China-like system where we will deposit funds with private firms (Visa, Mastercard?) and use phone apps for transactions. Or the Federal Reserve will put in place a digital version of currency where we will have accounts with the Fed to use for transactions, either with cards or phone apps. Whatever the future of money, change will most probably be gradual and also emotionally difficult. I for one will miss leaving my pennies in the jars at check-outs.