There was a lot to digest in 2022: Inflation wasn’t transitory à la the Fed’s original thinking. Stock and bond prices went down. Grocery bills went up. And after one of the winningest investment streaks, the simple strategy of owning a passive basket of U.S. stocks stopped working.

Still, there were some pleasant surprises among the gut punches – and the good news is that we may be entering one of the most interesting times ever to be an investor. As we take stock of the past year, here are some things we recall:

1. Mean reversion wasn’t dead, just sleeping a long time. Mean reversion, the idea that asset prices eventually revert to their long-run average, lies at the core of our beliefs, but our faith was ruthlessly tested the last decade. Growth stocks seemed unstoppable, soaring to the sky and making us wonder by what magic they defied gravity. Until this year, that is. In 2022, a new regime of higher interest rates and macro risk brought mean reversion back – and we think, reason.

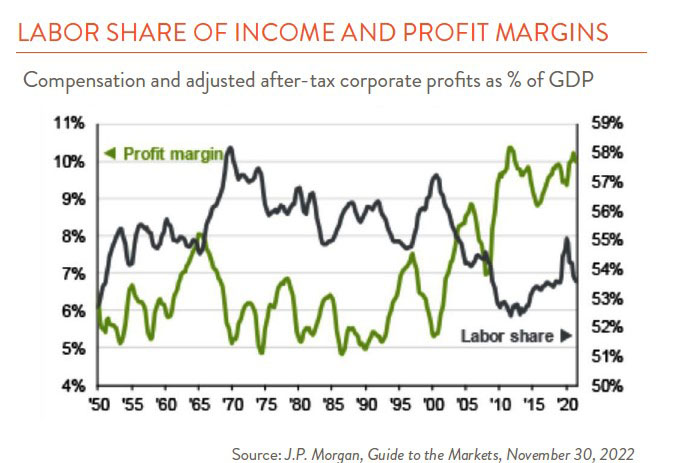

2. Corporate profits were surprisingly resilient. With each quarter that passed, we thought we’d finally see corporate profits roll over and maybe get crushed. Margins have been at historic highs that just didn’t seem sustainable (see chart to right) – and yet they’ve held on longer than we expected, even in the face of extraordinary inflationary pressure.

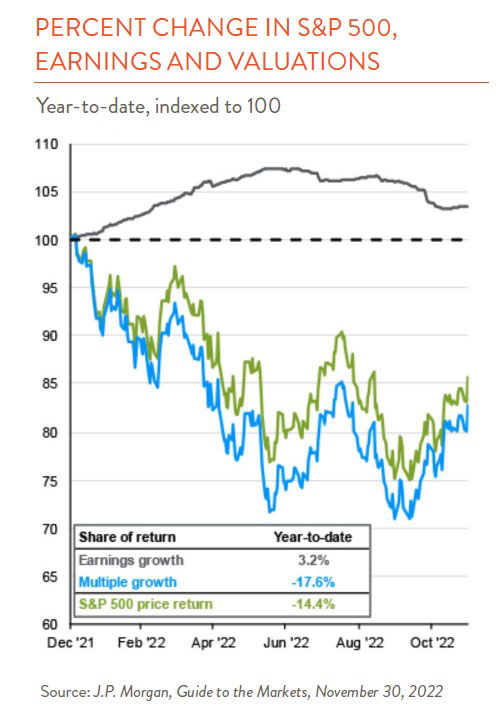

What has collapsed this year are price-earnings ratios, or the multiples investors have been willing to pay for risky assets (see chart below). That’s made stocks cheaper — but if a sharp decline in corporate earnings materializes, as we think it will, stocks could get cheaper still.

3. Tech network effects aren’t as powerful as we thought. Network effects happen when a platform becomes more valuable as it gains users, and they’ve long been considered a powerful source of competitive advantage for big tech companies. In other words, the more users Facebook gains, the more valuable it becomes – and likewise for Uber and Netflix.

But network effects have not made companies as unassailable as we thought. Netflix aimed for ever more users (and their data) so it could generate more content, which in turn would attract more users and help it dominate its market. But this ultimately didn’t stave off fierce competition from Disney and others – nor has Facebook had an easy time keeping the much smaller TikTok at bay.

4. Investing in China is risky – but that’s the same as it ever was. Investors have been in shock since Xi Jinping cracked down on big tech, wiped out the for-profit education sector, and consolidated absolute political power. But high risk in China is nothing new. China has been unpredictable since we started looking at Chinese companies in the early 2000s. If it wasn’t accounting scandals, or companies arbitrarily “going dark,” it was the structure of the “Variable Interest Entity.” Investors always have been able to find something wrong with China. That shouldn’t be a surprise.

5. ESG, or Environmental, Social, and Governance investing is more complicated than we thought. This is the year ESG investing went from being loved to doubted and then at times, reviled. After Russia invaded Ukraine and oil soared, ESG got put through the wringer – sometimes for good reason. But we think ESG investing holds promise. It is evolving, and this year, we learned that we have a lot more to learn about it.