Anyone looking to buy a house is aware of how big an impact mortgage rates have on monthly payments. At the start of 2021, rates were as low as 2.75% only to climb to above 7% last fall. For the median home in Vermont, a 2.75% mortgage works out to a monthly payment of $1,200. That jumps to $2,000 per month at today’s rates—for the same home!

Why did mortgage rates go up so much? Maybe you’ve heard vague explanations such as inflation and the Fed. But what really is in a mortgage rate?

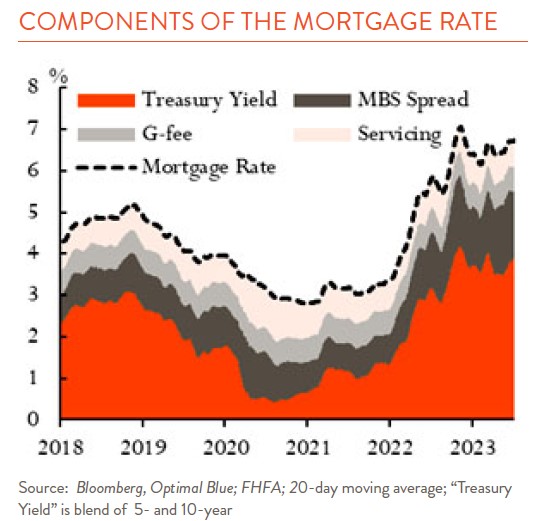

Before the lender even considers the borrower, there are four main components that add up to “set” the general level of mortgage rates. These include:

- The baseline level of interest rates (Treasury yields)

- The additional yield required by investors in mortgage-backed securities (MBS “spread”)

- The fee charged to guarantee the credit risk of a mortgage (“G-fee”)

- The costs associated with servicing and administering the loan (servicing)

The chart here shows how these components have evolved over the past five years. Each will be discussed, though the rise in Treasury yields and MBS spreads has accounted for all the increase in mortgage rates.

TREASURY YIELDS (4.20%)

From a low of 0.35% to 4.20% today, the rise in Treasury yields explains most of the increase in mortgage rates. This has largely been a result of higher inflation and Fed interest rate hikes, though there are myriad other factors that influence Treasury yields such as expectations for economic growth, the supply of government debt, and global risk sentiment. Treasury yields can be thought of as the “baseline” because they are the reference point for other interest rates, including mortgages.

MBS SPREAD (1.75%)

The second factor pushing up mortgage rates is the additional yield over Treasuries for MBS, which rose from 0.60% at the low to 1.75% today. Most mortgages are pooled with thousands of others and sold to investors as MBS, meaning an investor ultimately finances your home. Investors require additional yield above Treasuries, called the “MBS spread,” for the uncertainty in MBS cash flows. Unlike Treasuries, mortgages can be refinanced at any time, which can dramatically throw off an investor’s expectation for when they get their money back and how much interest they earn. As a result, MBS investors spend a lot of time dialing in their expectations for refinancing activity. Refinancing is driven predominantly by borrowers obtaining a lower interest rate, so when interest rates are volatile (clouding their forecasts) or market pricing indicates lower future interest rates (refinancing ahead!), MBS investors require a higher yield. Both conditions have been present since the Fed began raising rates last year. And along with rate increases, the Fed also stopped buying vast quantities of MBS. This had been keeping MBS yields abnormally close to Treasuries.

Additionally, remember the banks that failed? Together they had around $100 billion of MBS, which the FDIC took over and has been auctioning off. Those sales have contributed to wider spreads and kept mortgage rates elevated.

GUARANTEE FEES (0.60%)

The “G-fee” is usually static and makes up around 0.60% percentage points of the mortgage rate. The G-fee represents credit risk. It is what the housing finance agencies, Fannie Mae, Freddie Mac, and Ginnie Mae charge to shoulder the risk of default for mortgages bundled together in MBS they guarantee.

LOAN SERVICING (0.50%)

Servicing is the one piece that has come down since the start of the pandemic, when it averaged around 0.75% versus today’s 0.50%. Servicing is the mortgage lender’s take for administering the loan and interfacing with the borrower, some mix of profit and costs. The servicing component has declined as lenders have competed over fewer mortgage applications with rates up so much.

With these components setting the general mortgage rate, lenders then adjust it for specific borrower characteristics such as credit score, loan size, loan-to-value, and the type of property (e.g. second home). Higher FICO borrowers with higher down payments might see 0.10% taken off, while lower FICO borrowers with lower down payments might see 0.40% tacked on. Though that is all for FICO scores considered “prime,” subprime mortgage rates can be much higher.