Financial innovation is a feature of the investing world. In the not-too-distant past you had to pay $15 per trade or more to buy stocks in whole-share denominations. Nowadays, trades are almost always zero-commission, and you can buy fractional ownership of stocks through exchange-traded funds (ETFs). But innovation has not stopped there. Why buy a cookie-cutter index ETF created by a large financial institution when you can customize one yourself? Enter: direct indexing, sometimes called personalized indexing.

Direct indexing is an investment approach where you own a representative sample of the individual securities in an index rather than buying a traditional mutual fund or ETF that tracks the entire index. Conceptually, instead of owning an S&P 500 ETF, you might hold 200-300 stocks from that group. The goal is to closely match the index’s performance and risk profile, while accessing some potential additional benefits.

Arguably the most meaningful benefit gained through direct indexing is the ability to personalize your portfolio based on your individual preferences. You can restrict your portfolio by company, industry, or across a multitude Environmental, Social, and Governance (ESG) concerns. For instance, you might choose to exclude fossil fuel stocks due to climate change concerns or increase your allocation to companies with more diverse boards. Beyond just ESG restrictions, you can also customize your portfolio to reflect other factors like emphasizing dividend paying stocks or those that generate higher free cash flow.

A second benefit is tax optimization. Normally when holding an ETF, you are limited to selling shares that represent the entire index, so even when some companies have losses, your overall ETF position may be at a gain. With direct indexing you own the individual securities that make up the index, which allows you to opportunistically sell individual positions with losses to offset gains.

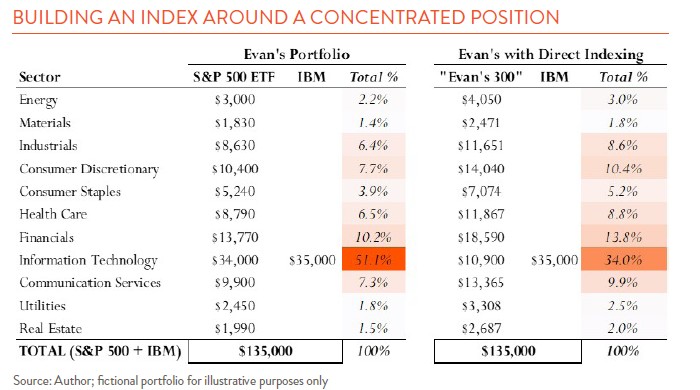

A final benefit for some investors is the ability to better diversify around a concentrated position that you may be unable or unwilling to get out of all at once – maybe a stock purchased ages ago with a lot of unrealized capital gains. Your personal index can omit that holding or reduce the allocation to its industry while still trying to track the index. The table below shows an example of this strategy (though no comment on its merits or appropriateness) with a fictional portfolio holding $100k of the S&P 500 index and a concentrated $35k position in IBM. The columns on the left show a resulting allocation to the Information Technology sector of over 50% – much higher than the S&P 500’s. Direct indexing (“Evan’s 300”) removes some Tech exposure, presumably the stocks most like IBM, so that the overall portfolio matches the sector-level exposures in the S&P 500. Of course, under this approach, the fate of IBM will still have a big impact on performance.

Although direct indexing originated in the 1970s, it was mostly reserved for large institutional investors who had the scale and resources to manage it. Even into the early 2000s, high trading costs made it impractical for most individual investors. That has changed in the past decade. Advances in technology combined with major shifts in market operations, such as commission-free trading and access to fractional shares, have opened the door for retail investors.

But despite all the publicity, direct indexing isn’t without its drawbacks. For one, buying and selling hundreds of individual securities can lead to complex tax documents including 1099s filled with pages of transactions. Portfolio reporting can also be overwhelming, as investors may see hundreds of individual line items. Custodians are addressing some of these issues through summary-level reporting. Another concern is whether the additional costs are worth it as many firms charge additional fees for direct indexing.

As with most investment approaches, it’s useful to be suspicious about marketing spin. When measured against the costs, the hype around tax optimization and customization may overstate the actual benefits. We are watching this space, especially as the industry works out the logistical hurdles.