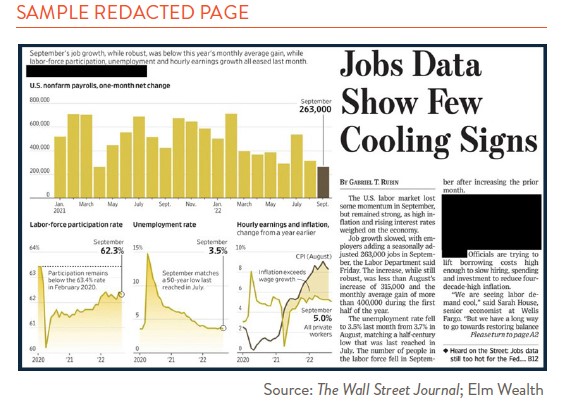

It is an unbelievable scenario: you have access to the front-page headline of The Wall Street Journal one day before it is published. You can use this information to trade, and you are provided with funds to do so. It sounds like a surefire way to become rich! Is it legal? Yes, because it isn’t real. It is the backdrop for a game concocted by Elm Wealth, detailed in a recent Wall Street Journal article.

The gist is, players are presented with slightly redacted headlines for 15 different days and the ability to buy or sell (short) both stocks and bonds, with leverage. Knowing how the day played out but not the change in market prices, would one be able to make money over time? The end result is…not quite.

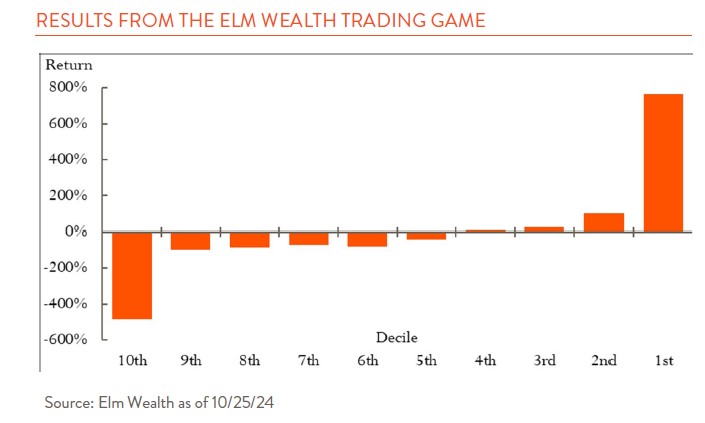

With over 10,000 participants, the median result was a 43% loss, and only 37% of players made money (see chart below)! A small group of players made quite a tidy profit – remember they have tomorrow’s paper! – but fewer than half the trades even picked the right direction. Members of the team at H+D also played the game. We did not fare much better.

How can this be explained? How can we have access to key trading information and still get it wrong? One answer is that we lacked the context of the broader economic and financial environment in the days and weeks leading up to the headline. So much depends on expectations – will “good news” be well received by the market or was it not good enough? Maybe it was too good and spells a harsher policy response and ends up being “bad news.” Or maybe the good news was simply expected and baked into the price.

Behavioral biases and other factors are also at play for market participants each day. Chief among them are overconfidence and confirmation biases. These helped contribute to an excessive use of leverage in the game. The study authors report that position sizing was all over the place for the average player. When they invited seasoned traders to play, they performed much better overall and did a better job matching the size of their bet with their conviction in the trade. Notably, they also sat out on 1/3rd of trading days. They knew better when to hold and stay on the sidelines.

At H+D, we enjoy seeing an exercise like this because it reinforces our view that it is nearly impossible to guess what direction the market will move in the short term (even when provided with extra information). There are too many forces at work, some economic and some not, to anticipate exactly how prices will behave each day, or even each week or each year. To us, a game like this exemplifies the difficulty of trading. And that is why we are not in the business of trading, but rather, investing.

As investors, we understand that when we buy a stock, we are purchasing a piece of ownership that entitles us to the profit and loss of that company. Such fortunes rarely play out over days. We would much rather buy into strong businesses (at good prices) and hold them over long periods. If only the Crystal Ball game had shared company headlines from 10 years in the future, not one day – now that is more like the game we are playing.