ESG investing – the practice of incorporating Environmental, Social, and Governance considerations into investment decisions — has been stirring up a lot of debate and emotions. At least in the mainstream press, it can seem like ESG went from investment darling to reviled failure in a very short time. But that is glossing over a great deal – because it has never been simple to combine investing with values and social impact.

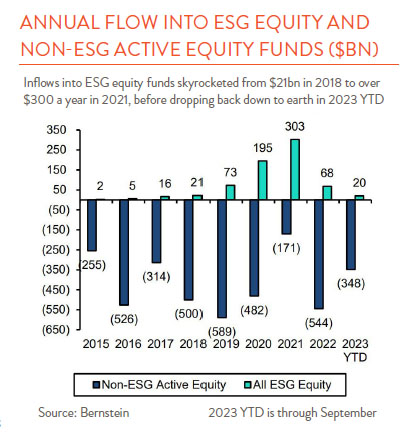

Between 2018 and 2021, inflows into ESG equity funds ballooned from $18 billion to $300 billion as their popularity soared. But then, as often happens with these boomlets, things changed and ESG inflows quickly plummeted again (see chart at right). Hard questions that were glossed over in the good times started getting asked. The renewable energy sector, which many see as a core component of ESG investing, collapsed as interest rates rose. And that’s not even mentioning the politically charged “anti-ESG” backlash that put a target on ESG’s back. As of September, regulators in 20 states had imposed rules that banned or discouraged investment pools from considering ESG factors.

But it’s important to remember that ESG is no flash in the pan. The idea of aligning investment choices with values has been around for centuries. As early as the 1700s, the Quakers refused to invest in the slave trade and later, in alcohol, tobacco, and firearms – a practice also adopted by other religious groups. Investors in the 1970s and 1980s tied investment choices to environmental issues and anti-apartheid principles. And we at Hanson+Doremus also have spent two decades delivering what we once called “socially responsible investing” to clients who demanded it. In the early days, this mostly meant avoiding fossil fuel producers and companies with poor labor practices (negative screening) while also identifying renewable energy investments, the area of greatest interest for our clients (positive impact). Since then, the choices have greatly expanded.

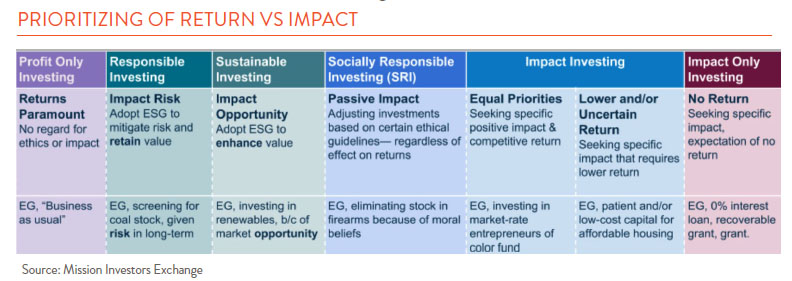

As the chart below shows, a full spectrum of opportunities has evolved for investors of all stripes. The chart’s specific terminology isn’t important (and similar charts use slightly different terms). What is important is how the relative importance of financial return versus social impact shifts as you move from left to right. Traditional investing, on the left, requires market returns; below-market returns become more acceptable as you move to the right, though you don’t automatically need to trade off return for high impact (And note: a below-market return does not necessarily mean zero; some very thoughtful portfolios combine above- and below-market returns in interesting, intentional ways).

Each of us can locate ourselves somewhere on this chart by identifying what is most important to us – and likely, many of us could see ourselves invested across multiple categories. But the choices are situational and highly personal. Herein lies the challenge of ESG and impact investing: It is complex. One person’s ESG saint could be another’s ESG sinner. And like all good investing, good ESG investing takes hard work.

Perhaps the criticism we could level at the investors who jumped into and out of ESG so quickly is that they thought it would be easy – and when things got hard, they lost patience. More blame, however, could be assigned to the fund companies who were too quick to market easily having it all – great returns and social impact. While there are many fine funds who have long embraced ESG’s complexity, some recent entrants abandoned ship when performance faltered. The Wall Street Journal and Morningstar reported in November that it counted six funds that dropped their ESG mandate and another 32 that decided to close.

The good news is that now that the hype has deflated, valuations look more attractive – and there is more promise ahead. We may call ESG investing something different in the future – and the way we do it will change. But like all great investing, ESG investing will require patience.