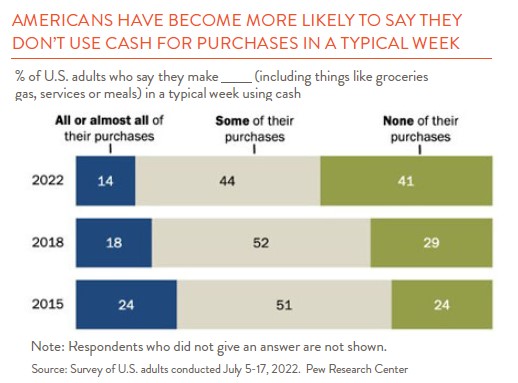

Our lives over the last 20 years have moved increasingly online as everything from newspapers to banking have gone digital. Every year more people make all of their daily purchases via credit cards. Fewer than 14% of Americans in 2022 made all or almost all their purchases in a typical week with cash versus 41% who made none of their purchases in cash according to Pew Research. In 2015, 24% of Americans were on either side of the spectrum as seen below. Several factors likely influenced this shift, including faster credit card transactions (tap to pay), online shopping growth, the pandemic, and younger consumers that often carry little to no cash.

As fewer Americans carry cash, stores are installing more self-checkout and credit-only lanes. Some chains have gone further, particularly in large cities. In Chicago, Sweetgreen, a pricey salad chain, and Dos Torros, a high quality Chipotle competitor, both opened cashless locations within the same block in 2017. Sweetgreen reported that its cashless stores recorded 15% more transactions per hour than standard ones and also saved two hours per day on cash management like balancing registers and making deposits. These gains led the chain to go cashless across all locations despite the credit processing charges that average around 2.2% for Visa and Mastercard.

While the cashless trend suits younger consumers and the well-off, many Americans still lack access to credit or debit cards, locking them out of these stores. There are roughly six million “unbanked” consumers in the U.S. today. Despite the fact that every U.S. bill states, “This note is legal tender for all debts, public and private,” there is no federal law that prohibits businesses from refusing to accept cash. To fill this breach, some cities like New York and Philadelphia and states like Massachusetts and New Jersey passed laws forcing businesses to accept cash. Even with these laws, larger retailers are looking for ways to induce shoppers to use credit cards. Both Walmart and Target are adding self-service checkout lines while reducing the number of staffed cash registers.

At the opposite end of the spectrum, some smaller retailers have added a surcharge for credit card (but not debit card) payments, and others have added a minimum charge amount. These practices, while legal in most states, are highly discouraged by credit card networks like Visa and Mastercard, which are trying to maximize card usage. The surcharge may also drive shoppers to competitors including large chains. The relatively high acceptance rate for surcharges means that the trend is likely to continue. A study by PYMNTS and Payroc found that while 58% of users that had never been asked to pay a surcharge would resist paying it, 85% that had previously paid one would accept the fee.

The march towards a cashless future continues at large retailers but not without pushback. Sweetgreen has reversed its previous decision to go cashless across all stores after public complaints. Some consumers will continue to prefer cash for privacy reasons and as a method to curb spending. Others are simply unable to qualify for a credit card. We are moving haltingly towards a cashless society, but don’t expect your greenbacks to disappear soon.