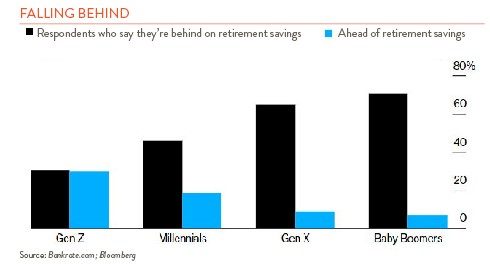

Americans have long struggled to save enough for retirement, and unfortunately, the recent bout of inflation has not made that job any easier. In a recent survey, online financial publication Bankrate found that 55% of respondents reported feeling behind in their retirement savings, up from 52% last year (see chart below). To help bolster Americans’ retirement security, Congress passed the Secure Act back in 2019. While this was a good first step, the House and Senate have been working since then on further enhancements. The culmination of these efforts, the SECURE Act 2.0 (SA2), was passed as part of the Omnibus Budget Act in the waning hours of 2022. Like a lot of legislation, there is a little bit of something for everyone in this bill. Here is a summary of how some groups benefit from this recent effort.

Part Timers: Temporary workers are often excluded from participating in company sponsored retirement plans. SA2 helps correct this by reducing the number of work hours required for employees to join a plan.

Lower Income Earners: SA2 changes the current, federal “Saver’s Tax Credit” (available to lower income filers) from a cash tax refund to a matching contribution that is deposited directly into a taxpayer’s retirement account.

Job Switchers: The average U.S. worker will have twelve jobs in their lifetime. Keeping track of the accounts resulting from multiple jobs can be challenging. To ease this burden, SA2 allows employees to transfer “default” IRAs into a new employer’s plan and further encourages rollovers. The Act also calls for the creation of a national database for “lost and found” 401(k) accounts.

Student Debt Holders: Beginning in 2024, employers will be able to make retirement contributions equal to the amount of an employee’s student loan payment regardless of whether the employee elects a deferral or not.

College Savers: Individuals with unused funds in an old (15 years at least) 529 plan will be able to roll-over up to $35,000 into a Roth IRA.

Older Workers: SA2 expands the “catch-up” contribution limits for older workers. Beginning in 2023, workers who are over 50 can add an additional $7,500 to their plan and beginning in 2025, 60-63 year-olds can expand their contributions by the greater amount of $10,000 or 50% more than the regular allowed 2024 amount. For higher earners, these “catch-ups,” will be treated as after-tax additions.

Retirees: SA2 extends the age at which you must take distributions (RMDs.) Beginning in 2023, the RMD age shifts from 72 to 73 and then in 2033, it shifts to 75. For those who miss these RMD deadlines, the good news is that the previously onerous penalties (50% of undistributed amounts) are reduced.

Employers: Today, approximately 40% of workers do not have access to a company sponsored defined contribution plan. To address this, SA2 expands the tax credits available to smaller firms setting up new plans. To get more employees to sign up, the Act will require, beginning in 2025, most companies to automatically enroll workers. Importantly, employers will also be able to offer emergency savings accounts to participating employees. Employees can contribute up to $2,500 to these accounts and the funds can be withdrawn penalty-free. SA2 also allows employees to withdraw another $1,000 per year from their retirement plan to cover emergency expenses. While these distributions may be taxable, they can be repaid and will not be subject to the typical 10% early withdrawal penalty tax.

Provisions of the Act are complicated so employees and plan sponsors alike should be sure to review them with their accountants and financial advisors to assess potential benefits. But make no mistake, despite all its complexities SA2 is an important step in the right direction and should, over time, improve Americans’ retirement security.